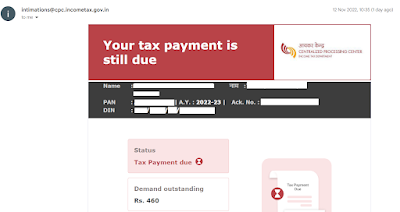

Recently, one of my friends received this email from the income

tax India department. He told me that he paid for it in the month of June. But he

doesn’t have the payment challan with him. The Indian IT department has the worst

practice in that if someone paid the tax, they need to manually submit the challan

details on the response page. If you have the Challan, then visit the site: https://eportal.incometax.gov.in/iec/foservices/#/dashboard

click the pending task > outstanding response > here you can agree

whether this payment is due or not. If you need to pay, you can pay directly using net banking and you need to submit the challan details as the attachment (as

well as internal contents in the details box – which is total nonsense in the

digital era).

Note: Please use this article as educational content and

share it with the folks who are currently dealing with the payment due.

Post by

No comments:

Post a Comment